The Health Insurance Trap, and How To Escape It.

The Sovereign Health Fund that takes you from losing $21,000 to saving $189,000.

Many months ago I wrote an article questioning if you really need a health insurance plan. Generally, I view health insurance as the least-effective means by which we can guarantee our health and sovereignty.

For most people, however, not having any insurance is a bit anxiety-inducing. I can understand this.

When considering alternative options to health insurance, people will quickly ask:

“What do I do about a catastrophic medical expense?”

In my opinion, the ideal strategy concerns two objectives:

Save/grow your money.

Minimize your exposure to unexpected health events.

The second goal is both a financial strategy, but also a health strategy. Because, the best way to reduce your exposure to an unexpected health event is to improve the foundation for your health.

But, this article is about financial strategy.

In the first place, we need a clear path to a solution which can cover both everyday and unexpected medical costs.

Secondly, this path must entail saving your money (instead of giving it to insurance companies). Because you don’t get back any of the premiums you are paying every month. This is an annual money sink.

The Problem

This strategy will require some legwork, discipline, and consistency.

To motivate us, it is important to know what the problem is.

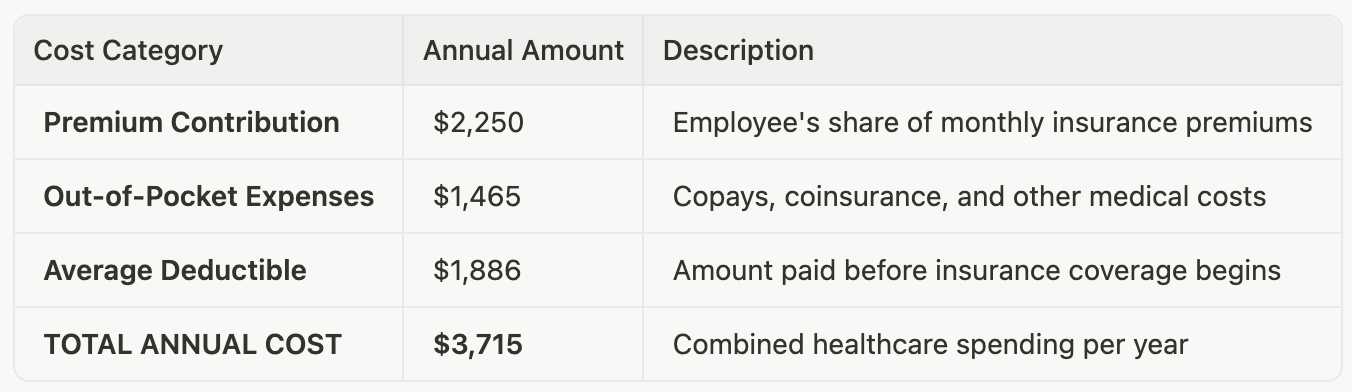

According to the latest data from KFF’s 2025 Employer Health Benefits Survey, the average individual bears the following annual costs:

These are median numbers for individuals with single coverage under employer-sponsored insurance. For many Americans, these costs can be substantially higher. Workers at small firms face average deductibles of $2,631, and more than half face deductibles exceeding $2,000 annually.

What’s worse is these expenses continue to rise, outpacing inflation.

For instance, in 2025 health insurance cost rose 6%. In 2026, it is projected to rise by about 7%.

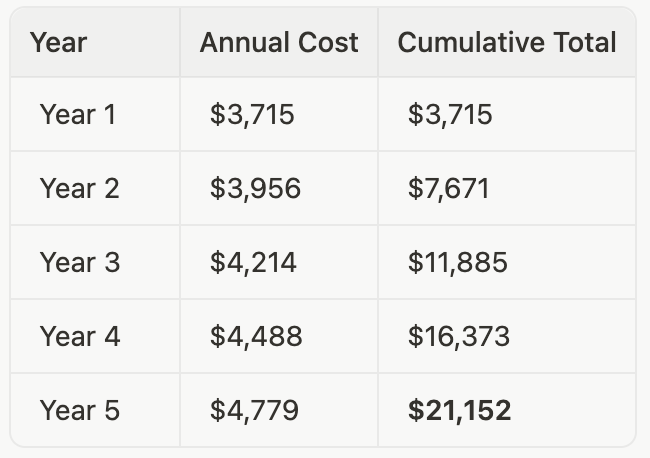

Assuming a 6.5% annual increase (in line with 2026 projections), the traditional approach to healthcare spending looks like this:

That’s $21,152 that you spend over 5-years to have the privilege of insurance covering additional costs.

This is just for a single-person with an employer that covers most of the insurance premiums.

You can imagine the numbers for someone paying entirely for their own insurance, or coverage for a family.

The solution I propose is two-tiered.

First, we rapidly build a fund and strategy to cover any and all health expenses with minimum out-of-pocket cost and maximum control and possession of our hard-earned money.

Second, we slowly build a broader fund which primarily accrues our wealth for any and all unexpected expenses. Often we are restricted by insurance plans in the following ways:

Who the funds can help

How this person can be helped

Where this person can be helped

With our second phase, our objective is strengthen our resolve and support for family and loved-ones near or far. Because if you look at any set of “benefits” that are available for purchase, you will quickly find that there is far more than just “health insurance.”

Dental

Vision

Critical illness

Hospital indemnity

Short and long-term disability

Life insurance

Accidental death and dismemberment insurance

The Sovereign Health Fund

As mentioned above, the first problem we need to solve is rapid accumulation of funds towards coverage of any and large (or catastrophic) healthcare expenses.

This is the first goal because often times this is the biggest obstacle stopping people from letting go of their health insurance plan. Everyone is worried about that unexpected emergency room visit, surgery or diagnosis which can leave their finances decimated.